- Home

- ATRA Newsletters: 2024

- ATRA Newsletters: 2024

- ATRA's 2012 Legislative Program

- ATRA Unveils 2011 Legislative Program

- Recession Drove Down Tax Collections, Not Public Payrolls

- Governor Signs Arizona Competitiveness Package

- 2011 Legislative Wrap-Up - Major ATRA Initiatives Pass

- Third-Party City Tax Collections/Audits Stopped

- Statewide Property Values Decline Again

- Governor Brewer Appoints Jennifer Stielow To School Facilities Board

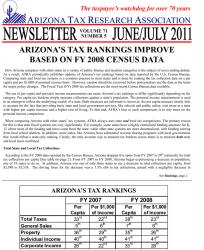

- Arizona's Tax Rankings Improve Based On FY 2008 Census Data

- Growth In College Budgets Supported By Higher Property Taxes & Tuition

- Counties Respond Differently To State Shifts & Declining Property Values

- Statewide Average Property Tax Rate On The Rise

- Arizona's Sales Tax Rates 2nd highest In The Country

- $1.9 Billion In School Property Tax Increases On November Ballot

- Lawmakers Provide Insight On Major Policy Issues For Upcoming Session

- Eileen Klein Provides Luncheon Keynote Address

- McCarthy OutlinesTop Fiscal Issues

- Lyn White Elected New ATRA Chairman

- Legislative Leadership Focuses On Deficit, Economy

- Senator Bob Burns Receives ATRA's Watchdog Award

- Tax Experts Provide Arizona Tax 101 Overview

- JLBC Director Provides Update on State's Fiscal Woes

- Counties Adopt FY 2011 Budgets

- Arizona’s Business Property Tax Ranking Improves According To Recent Minnesota Taxpayer’s Study

- School Bond & Override Election Results

- Ben Nowicki Joins ATRA Staff

- Statewide Average Property Tax Rate Jumps 47 Cents

- Total City Levies Fall As Valuations Decrease

- Businesses Deserve City Sales Tax Code Reform

- Valuation Decreases Drive Primary Tax Rate Increases In Some Arizona Counties

- Community College District Levies Grow $18 Million Despite Reduced Property Values

- Oklahoma Legislature Bans For-Profit Tax Collectors

- ATRA Board Votes To Support Propositions 301 And 302

- Proposition 100 Passes

- Lawsuit Increases Pima County Taxes

- McCarthy Appointed To ASRS Board

- Legislature Adjourns With Mixed Results

- ATRA's GPLET Reforms Finally Become Law

- Salaries And Benefits Dominate State And Local Government Budgets; AZ Public Employees Rank 4th In Adjusted Average Salaries

- Arizona's Pension Plans Need Reform

- 2010 ATRA Legislative Program

- Schuldt Appointed To The Debt Oversight Commission

- Letter To Cities And Towns Describes ATRA's Opposition To RDS Contract

- ATRA’s 2009 Legislative Program

- Statewide Property Tax Levies Approaching $7 Billion

- ATRA Makes FY 2010 Budget Recommendations

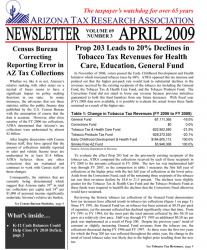

- Census Bureau Correcting Reporting Error In AZ Tax Collections

- Prop 203 Leads To 20% Declines In Tobacco Tax Revenues For Health Care, Education, General Fund

- K-12 Cash Balances Could Help Close FY 2010 Deficit

- Legislature Wraps Up Regular Session; Special Session Grows State Budget Deficit

- Governor Brewer Signs Three ATRA Bills

- Primary Assessed Values Continue to Climb; Minimal Growth In Secondary Values Statewide

- Failure Of GPLET Reform Creates Uncertainty

- Prop 101 Responsible For Reductions In Primary Property Tax Rates

- Community College Primary Levies Increase $26.1 million (4.6%)

- Statewide Average Property Tax Rate Drops Three Cents

- ATRA Board Pulls Support For Sales Tax Referral

- Override Expansion Increases School District Inequities

- Arizona’s State & Local Tax Burden’s About Average

- 44.4% Of School District Spending Measures Rejected

- Legislative Leaders Address ATRA Outlook Luncheon

- Congressman Flake Receives ATRA’s Watchdog Award

- Treasurer Martin Describes State’s Cash Flow Woes

- Larry Lucero Elected New ATRA Chairman

- ATRA's 2008 Legislative Review

- Arizona's State And Local Debt Climbs

- House Kills Secondary Levy Limits

- House Passes State Rate Repeal

- Unlimited Fire District Levies Drive Up FDAT Levies

- Governor Vetoes Property Tax Relief

- Primary Net Assessed Values Climb 16% Despite Drop In Housing Market

- AZ Ranks 4th In The Nation In School Funding Increases

- Governor, Legislature Fail To Protect Property Taxpayers

- Governor's Veto Message Short On Facts

- ATRA Tax Practitioner Bill Becomes Law

- Maria Travers Joins ATRA Staff

- State "Budget" Finally Passed; $1.3 Billion Structural Deficit

- Fire District Merger Abuses Fire District Assistance Tax

- State to Fund Excess Utilities And Teacher Performance Pay

- ATRA Opposes TIME Initiative

- ATRA Supports Majority Rule Initiative

- ATRA Supports Protect Our Home Initiative

- Vetoes Lead To Property Tax Increases For Some Taxpayers

- ATRA Supports School District Unification

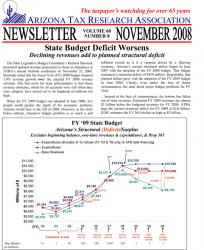

- State Budget Deficit Worsens; Declining Revenues Add To Planned Structural Deficit

- Statewide Average Property Tax Rate Dips to $9.23 - An 81 Cent Drop

- School Districts Budget $590 Million For Budget Limit Exemptions

- New Leadership Addresses ATRA Outlook Conference

- Rounds Provides Grim Economic Outlook

- Olson, McCarthy Highlight Budget, School Finance Problems

- Steve Barela Named 2008 Outstanding Member

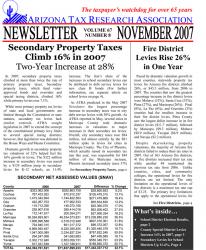

- Secondary Property Taxes Climb 16% In 2007; Two Year Increase At 28%

- Fire District Levies Rise 26%

- School District Election Results

- County Special District Levies Increase 33% On Average

- State Average Property Tax Rate Drops Another 95 Cents

- State Tax Revenues Exceed $22 Billion In FY 2006

- Desegregation Levies Climb $6.1 Million

- Budget Agreement Speeds Up Tax Reform

- Supreme Court Of Arizona Hands Taxpayers A Victory

- Taxpayers Fund up to $10,094 Per Community College FTSE

- Proposition 101 Drives Down 2007 Primary Tax Rates

- Urban Revenue Sharing Climbs 61% In Two Years

- Governor Signs Two ATRA Tax Practitioner Bills

- Arizona Ranks 11th In The Nation For Average Instructional Pay

- April 24th Marked Arizona's Tax Freedom Day

- Maricopa Cities Plan Huge Property Tax Increases

- Statewide Community College Enrollments Drop; Funding Set To Increase

- Total Statewide Debt Reaches $28.9 Billion After A $2.4 Billion Boost In FY 2006

- Statewide Secondary Net Assessed Values Hit Record 32% Growth

- Justin Olson Joins ATRA Staff

- Fire District Levies Increase 84% Over A 5 Year Period

- Five-Year Growth In School Overrides Amount To 92%

- ATRA's Legislative Agenda Off To A Good Start

- Jennifer Schuldt Named ATRA Vice President

- Dual Enrollment Recommendations Sidelined

- Two Bills Move To Accelerate Reduction In Business Assessment Ratios

- Gretchen Kitchel Is Reelected As ATRA's Board Chairman

- Treasurer-Elect Dean Martin Highlights Outlook Luncheon Program

- House And Senate Leadership Address ATRA Outlook Conference

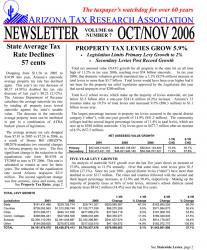

- State Average Tax Rate Declines 57 Cents

- Property Tax Levies Grow 5.9%

- Desegregation Levies Countinue To Increase

- Legislation Forces Local Government Tax Rates Down

- Tax Increases Continue After Vetoes

- HB2712 Begins A New Era for Tax Practitioners and Taxpayers

- Cities Increase Tax Burden On Newcomers

- Vote No On Prop 203

- Proposition 101- Support Reasonable Property Tax Limits

- Proposition 106 - Oppose Deferring Major Plubic Policy To An Appointed Board

- Proposition 203 - A Fiscal Hazard Arizonans Should Avoid

- ATRA Property Tax Recommendations Signed

- U.S. Senator John Kyl Receives ATRA Watchdog Award

- SB1205 Reforms Flawed K-12 Formula

- Governor Vetoes Property Tax Protections

- Arizona State & Local Debt Reaches $26.5 Billion

- Cities Target Specific TPT Classes For Increases

- Two Bad Bills Still Alive

- Arizona's Tax Freedom Day Falls On April 20th

- Legislature Debates Property Tax Relief

- ATRA To Honor Senator Kyl

- Legislative Update

- Property Tax Shell Game Is Wearing Thin

- ATRA's 2006 Legislative Program Moving

- Hawkeye Wilson Joins ATRA Staff

- Two County's Provide Employee Mid-year Raises

- Governor, Legislature Offer Dramatically Different Budgets

- Gretchen Kitchel Reelected 2006 ATRA Chairman

- Key Legislators Address ATRA Outlook Conference

- Governor's Budget Director Offers Fiscal Perspective

- McCarthy, Keith Russell Focus On Property Taxes

- ATRA Honors Cathy Connolly

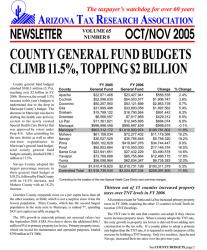

- County General Fund Budgets Climb 11.5%, Topping $2 Billion

- Highest Combined Tax Rates For 2005 By County

- Gov's Veto Allows Rates To Increase In Highly Burdened School Districts

- JTED Mess Gets Worse

- Property Valuations Climb 10%, 5-year Growth At 54%

- Committee on Hayden Property Taxes Adopts Recommendations

- Community College Adopted Budgets Up 9.7%

- Intel Announcement Jump Starts Sales Factor Change

- Yuma County Creates Public Health Services District Without Voter Approval

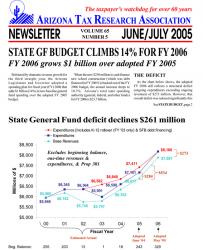

- State GF Budget Climbs 14% For FY 2006

- Pima County Increasing Special District Taxes

- Town Of Hayden Receives Award For Demolishing Buildings

- Property Tax Reform Signed Into Law

- J. Elliott Hibbs Receives ATRA Good Government Award

- Two More Successes For Tax Practitioners Bills

- Governor Signs Sales Factor Bill

- Governor Signs Municipal Sales Tax Refund Legislation

- Governor Vetoes Deseg/OCR Property Tax Reform

- A Snapshot of Statewide Debt

- 2005 Valuation Growth Reaches 10%

- Governor Napolitano Vetoes Property Tax Reform Bill Along With Budget Bills

- ATRA Tax Practitioner Committee Bills Progressing

- Desg/OCR Funding Reform Now Up To State Senate

- Statewide Effective Property Tax Rates Reflect Inequitable Distribution Of Tax Burden

- Improving Arizona's Financial Management; State Budget Recommendations

- Gretchen Kitchel Elected ATRA Chairman

- Top Legislators Address ATRA Outlook Conference

- Good Government Award Goes To Alhambra Official

- Legislative Budget Director Offers Optimistic Outlook, And Warnings

- Property Tax Levies Exceed $5 Billion

- Primary Levies Grow 42% Over 5 Years

- K-12 Secondary Levies Climb $70 Million

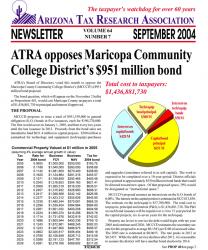

- ATRA Opposes Maricopa Community College District's $951 Million Bond

- Prop 401

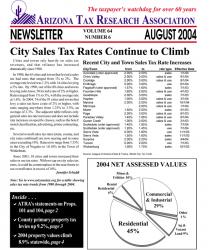

- City Sales Tax Rates Continue To Climb

- ATRA Statements On Propositions

- County Primary Property Tax Levies Up 9.2% In 2004

- 2004 Property Values Climb 8.9% Statewide

- U.S. Senator John McCain Receives ATRA Watchdog Award

- Community College General Fund Budgets up $59 Million Statewide

- Maricopa Colleges Will Put Up $951 Million Bond Proposal To Voters In November

- FY 2005 State General Fund Climbs $855 Million

- State Loses Excess Utilities Suit

- Tax For Santa Cruz College Fails At Ballot

- Legislature Keeps Fence Around Deseg/OCR

- General Fund Revenue Up

- A Victory For Taxpayers; Supreme Court Decides Capital Castings Case

- Statewide Debt Up 6% To Nearly $22 Billion

- Tax Reform Bills Killed In Senate

- Tax Reform Bills Advance

- Legislative Update

- House Ways & Means Rejects ATRA Proposal On Taxpayer Funded Publicity Pamphlets

- House Approves Deseg/OCR Reform Bills

- State Budget Deficit Continues

- Capitol Castings: The Case That Wouldn't Die

- School District Bond Debt Since Students First Hits $1.2 Billion

- Sunset Review Panel Recommends Extension Of Deseg/OCR Freeze

- Legislative Leaders Address ATRA Outlook Conference

- Kevin Kinsall Re-elected ATRA Chair

- Tom Liddy Gives Stirring Speech At Annual Meeting Luncheon

- County Budgets Up $150.8 Million

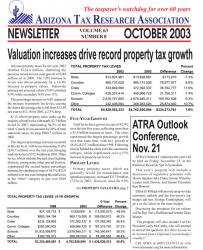

- Valuation Increases Drive Record Property Tax Growth

- Legislative Action Provides Tax Relief For TUSD Taxpayers, Others

- ATRA Offers Perspective And Research To Tax Reform Groups

- Prop 301 Kicks In: Average Instructional Staff Pay Increases

- Statewide Primary Net Assessed Values Up Over $38 Billion In Tax Year 2003

- Ghost Town In The Making?

- County Primary Levies Up

- Two-Thirds Of Counties, Colleges, Cities & Towns Exceed TNT Limits

- Tax Amnesty Offered

- Tax Reform Experts Provide Insight At ATRA Luncheon

- State Adopts FY 2004 Budget

- Legislature Circumvents Debt Limits

- Maricopa Hospital District Bill Passes

- Taxpayers Prevail: Navajo County In Violation of Constitutional Levy Limit

- Statewide Average Effective Property Tax Rates Reflect Inequitable Distribution Of Tax Burden

- Legislative Update

- ATRA Tax Practitioners Form SSTP Subcommittee

- Budget Deficit Provides Opportunities For Better Financial Management

- Update On Key Finance Bills

- Arizona's Average Instructional Staff Pay Rank Leads Nation As A Percentage Of Per Capita Personal Income

- ATRA's 2003 Legislative Program

- Statewide Debt Exceeds $20 Billion in FY 2002

- School District Capital Spending: We're #1

- ATRA's Legislative Program

- Local Government Increases Reliance On Property Taxes In 2002

- Union Elementary's Property Tax Rate Up 262%

- Combined Rate In Hayden Up

- Gila County Voters Approve "Provisional" College District

- Rep. Jeff Flake Addresses ATRA's 62nd Annual Meeting

- Kinsall Re-elected Chairman

- Expert Panel Reviews State Tax System

- ATRA Outlook Conferees Given Latest On State Economy And Budget

- Tobacco Taxes And Proposition 303

- County General Fund Budgets Get Boost Despite Struggling Economy

- Ad Hoc Committees Ready To Commence Work

- Who's In Charge Here? School Districts Ignore Recent Legislative Reform Efforts, Exacerbate State Budget Crisis

- School Districts Resist Reforms

- Arizona Tax Collections Rise Over Two Decades

- School Vouchers Aid Taxpayers, Too

- Community College Budgets And Taxes

- Pima Community College Spins Tax Override Election

- Legislature Adopts FY 03 Budget

- May Budget Revisions Get Some School Districts Around Excess Utilities Freeze

- School Elections For Capital Add To SFB Spending

- Tax and Fiscal Policy Reform On The Horizon

- McCarthy Appointed To School Facilities Board

- Bond Election Pamphlets To Provide More Info

- Legislature Reaffirms: Schools Are Not Allowed To Purchase Computers With Bonds

- Legislature Approves Deseg Freeze Bill

- Gubernatorial Candidates Discuss Tax And Fiscal Policy At ATRA Luncheon

- Property Tax Calendar Change Stopped

- Special Districts Bill Defeated

- 2-year Deseg Freeze Passes House 52-7

- Legislative Update: Bills To Keep An Eye On

- Arizona's Expenditure And Revenue Rankings

- ATRA To File Amicus Brief In Navajo County Appeal

- Gov's K-12 Task Force Recommendations

- Arizona's Average Instructional Staff Pay Rank Leads Nation As A Percentage Of Per Capita Personal Income

- Sales Tax Expansion Debate Heats Up

- Property Tax Issues Focus Of Tax Committee Speakers

- Board Elects Kevin Kinsall Chairman At ATRA's 61st Annual Meeting

- Columnist Bob Robb Refutes Twisted History of Arizona Public Policy With "Inconvenient Facts"

- Property Tax Levies Exceed $4 Billion Statewide

- Session Set To Close Budget Deficit

- Ways & Means Debates Deseg Levy Cap In Tucson

- County General Fund Budgets Up $22 Million

- TUSD Property Tax Hike Blamed On Prop 301 Sales Tax Increase

- Scottsdale Unified Deseg Levy Up 51%

- 5 Of 10 College Districts Raised Primary Property Taxes

- School District Budgets Reveal Deseg Taxation Has Reached New Heights

- No Tax Cuts Triggered This Year

- Pima County Board Adds On Yet Another TUSD Tax Increase

- Study Committees Begin Work

- TUSD Budget Includes 20% Hike In Desegregation Spending

- Gila County Proposes a 44-cent Increase In Primary Rate

- Community College Adopted Budgets

- School District Property Tax Increases Expected

- Governor Hull Vetoes Sales Tax Fix

- Small Tax Cut Maintains Streak

- Arizona's Individual Income Tax Compares Favorably

- Gov Signs ATRA's "Liabilities In Excess" Reform Bill

- Good/Bad News From 2001 Session

- ATRA Chairman Dick Foreman Appointed To Governor Hull's Task Force On Education Funding

- House Ed Rejects Limits On Capital Overrides 5 to 5

- Sales Tax Grandfathering Bills Moving

- HB2527 Expands Enterprise Zone Tax Breaks

- Legislative Activity In Full Swing

- PUHSD's Levy For "Liabilities" Halted

- Confusion Marks Implementation Of Prop 104

- Update on Public Finance & Taxation Bills

- Senate Finance Kills Truth In Taxation Bill

- Senate Rejects School District Excess Utilities Phase Down

- Arizona Sales Tax Reliance High

- State Comm College Board Adopts Dual Enrollment Rule

- ATRA's 2012 Legislative Program Moving

- Statewide Debt Grew $908 Million In FY2011

- ATRA's Property Valuation Limit Heads To November 2012 Ballot

- Other ATRA Legislation Makes It To The Finish Line

- YES On 117 Committee In Full Swing

- Sales Tax Increase Initiative Goes To Supreme Court

- Governor's Transaction Privilege Tax Simplification Task Force Convenes

- ATRA Ballot Arguments Submitted to the Secretary Of State

- Legislature Adjourns - ATRA Legislative Program Successful

- ATRA's Property Valuation Limit Measure Timely

- Mesa Unified Considers Bonds Well In Excess of Debt Limit

- Phoenix Ignores Debt Cash Reserves By Maintaining Combined Tax Rate

- PROP 117 Perfect Opportunity To Simplify AZ’s Property Tax System

- County Budgets Decline For Second Straight Year

- Voters Approve Prop 117 By Wide Margin

- JLBC's Stavneak Provides Outlook Conference Update On State's Fiscal Picture

- 2012 ATRA Outlook Conference Speakers

- Michael DiMaria Named 2012 Outstanding Member

- ATRA's 2013 Legislative Program

- ATRA 2013 Legislative Program Moving

- Rate Increases Drive Down Tobacco Tax Collections, Drive Up Smuggling

- Looming Budget Deficit Dominates As Legislative Leaders Address Outlook Conference

- Congressman Shadegg Receives ATRA's Watchdog Award

- ATRA Alum, Chris Kelling, Receives Outstanding Member Award

- 2007 ATRA Outlook Conference

- Senate Defeat Of HB2357 Allows Expansion Of Unlimited School Property Taxes

- TNT Compliance Bill Makes It To Finish Line

- ATRA Subcomittee Reviews Implications of SSTP In Arizona

- Major State Tax Rates

- Governor Signs Legislation To Protect Arizona's Machinery & Equipment Exemption

- Arizona Residents Rank Near Bottom In Income Tax Burden

- Statewide Debt Dropped in FY 2012

- Governor Brewer Signs Historic Sales Tax Reform Bill

- Legislation Doubles K-12 Debt Limits

- Governor Vetoes Bad Tax Legislation

- College Expenditure Limits Lack Accountability

- Arizona at Bottom of Property Tax Roller Coaster

- Property Tax Increases Prevalent among Community Colleges

- Majority of Counties to Adopt Tax Rates within TNT Limits

- Taxpayer Access to City Budget Information Lacking

- Most Arizona Counties Experience Growth in FY 2014 General Fund Budgets

- Statewide Property Tax Levies Fall Again

- The Chairs of the House & Senate Tax Committees Discuss Priorities for 2014 Session

- Congressman Paul Gosar Provides the Keynote Address at the ATRA Annual Awards Luncheon

- Fred Nicely Provides National Perspective on State and Local Taxes

- ATRA’s 2014 Legislative Program

- ATRA’s 2014 Legislative Program

- Sales Tax Uniformity

- Statewide Debt Report

- ATRA’s 2014 Legislative Program

- Sean McCarthy Joins ATRA Staff

- 2014 Legislative Session Wrap Up

- Comm Colleges Exaggerate Student Counts

- Arizona Educators Pay Highly Competitive

- Lessons from the City of Glendale

- Pima County Hammers Taxpayers

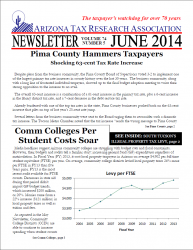

- Community Colleges Per Student Costs Soar

- South Tucson Illegally Levies

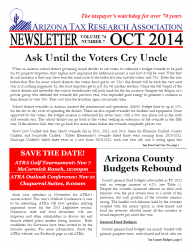

- Ask Until the Voters Cry Uncle

- Arizona County Budgets Rebound

- ATRA's Fall Events Update

- State Slammed with TUSD Deseg Costs

- MIHS Uses Tax Dollars on Electioneering

- ATRA Outlook Conference Highlights

- Former Chairman Balich Passes

- Dickerson Wins Lifetime Achievement Award

- 2015 ATRA Legislative Program

- ATRA Leads Opposition to Prop 480

- Deseg/OCR Levies Punish Phoenix Taxpayers

- Kathleen Farnsworth Joins ATRA Staff

- 2015 Legislative Program Update

- 2015 Legislative Session Wrap Up

- Comm Colleges Adjust Student Counts

- School Finance Equity; Deseg/OCR

- Policymakers Should Finish 1% Cap Reform

- Pinal Comm College Raises Taxes 48%

- Where to Eat & Stay in AZ

- Pima College Inflates Student Counts

- Study Ranks AZ Business Property Taxes High

- MIHS Using Bonds to Supplant General Fund

- Higley Unified Lease Purchased $75 Million Middle Schools

- Counties Increase Taxes, Blame State Cost Shifts

- Comm College Budgets, Students Down; Most Raise Taxes & Tuition

- Save the Date for ATRA Fall Events

- Prop 117 Perfectly Timed

- Better Watch Your Ballot!

- ATRA Fall Events Update

- Statewide Property Taxes Up Just 2.1%

- Isaac Elementary Tax Rate Skyrockets

- Fire Districts Call for Property Tax Increase

- Sean McCarthy appointed SFB Chairman

- Gov Ducey Promises to Protect Taxpayers

- Michael Preston Green Honored with Lifetime Achievement Award

- ATRA Outlook Highlights

- JLBC State Budget Update

- ATRA's 2016 Legislative Program

- Deseg/OCR Funding Overview

- Legislative Session Update

- Property Taxes Top $7 Billion

- GPLET Audit Reveals Problems

- Ducey Signs Adjacent Ways Reform Bill

- Legislature Dilutes Expenditure Limits

- New Laws for Local Governments this Year

- School Finance Reform Update

- MCCD Struggles With Internal Controls

- Several ATRA Bills Pass Legislature

- MIHS Uses Bond Funds to Determine How to Spend Bond Funds

- Most ATRA 'Bad Bills' Fail in 2016

- City of Phoenix Raises Tax Rates 19%

- Comm College Spending Even

- Gila Provisional College: Audit Impossible

- Fire Districts in Desperate Need of Reform

- Pima County Wins 1% Cap Lawsuit

- MIHS Budget Still in the Red

- County Budgets Healthy in FY17

- Schools Seek $1.4 Billion in Bonds

- TNT Notices in Error

- Phoenix Provides Tax Breaks for Select Downtown Residents

- Statewide Property Taxes up $326 Million

- Most City Tax Proposals Fail

- K-12 Bonds/Overrides Pass

- Fire Districts 50/50 on Elections

- Governor Ducey Highlights ATRA Outlook

- ATRA Outlook Wrap Up

- Steve Barela Elected ATRA Chairman

- Tom Manos Given Hibbs 'Good Government' Award

- Tim Lawless Named 2016 Outstanding Member

- Legislative Program Update

- AZ #2 in Nation for Cigarette Smuggling

- Agua Fria Builds $75M High School; Adjacent Ways to Pay for $6M

- GPLET Reform Bill Signed

- Effective Property Tax Rates Down in FY 2017

- Governor Ducey Signs 3 ATRA Bills

- April 15 is AZ's Tax Freedom Day

- Kevin McCarthy reappointed to ASRS

- Mohave Leads Counties for Property Tax Hikes

- Mesa Reignites Private Prison Debate

- Comm Colleges Pivot Amidst Student Declines

- Mission Creep in Public Health Service Districts

- College Budgets Flat in FY18

- TNT Laws Continue to Serve Taxpayers Well

- Pima County Tax Increase Aggravates 1% Cap Costs

- Bonds & Overrides Top $1.2 Billion

- Property Taxes Stabilize, Average Rate Drops

- County Budgets Maintain Healthy Growth Trend

- $800M in K-12 Bonds on November Ballots

- Measuring Arizona's Cost of Living

- ATRA Outlook Conference Wrap Up

- Joe Henchman of Tax Foundation on Federal Tax Reform

- Bark Named 2017 ATRA Outstanding Member

- Goldwater Institute Challenges Pinal PRTA Tax

- Lesser Known School Finance Problems

- Revisiting the Phx Convention Center

- Adjacent Ways Reform Bearing Fruit

- 2018 ATRA Legislative Program Update

- Higley Unified Redux

- Prop 117 Stabilizes Property Tax System

- State Farm Deal Has a GPLET Safety Valve

- DOR To Collect Troubled Pinal County Transit Tax

- HB2126 GPLET Reform Passes; A History

- ATRA to Oppose Income Tax Initiative

- Lawsuits Mount as State Fumbles Taxation of Digital Goods & Services

- Pima County/TUSD Challenge New Deseg Law

- SCOTUS Overturns Quill in Wayfair

- County & Comm College Tax Update

- Tax Court Rules PRTA Sales Tax Illegal

- Digital Goods & Services: How Did We Get Here?

- Wayfair Decision Creates Challenges

- Supremes Strike Massive Tax Increase From Ballot

- Rising Pension Costs Erode County Budgets

- Top 25 Highest Property Tax Jurisdictions

- ATRA Outlook Conference Wrap Up

- Mesnard Warns of Inaction on Conformity

- Updates on Wayfair/Taxing Remote Sellers

- Attorney General Sues ABOR over Abatement Deals

- Study Confirms Contracting Noncompliance High

- Income Tax Conformity Issue Languishes

- Bill Requiring Treasurers Mail Tax Bill Passes

- Effective Property Tax Rates Stable in AZ

- 2019 ATRA Legislative Program Update

- Paloma Elementary Skipped Public Vote For Years

- Tax Reform Package a Win for Taxpayers

- 2019 Legislative Session Wrap

- Weaknesses Revealed in Maricopa County Treasurer's Financial Operations

- Local Government Proposed Tax Increases

- Auditor General: Maricopa County's Pension Exclusions Improper

- What Happened to the Sales Tax Base?

- South Tucson Illegal Property Tax Case Settled

- State Shared Revenues Top $3 Billion

- Judge Shifts Local Deseg Taxes Back to State Taxpayers

- County/City Tax Update

- City Budgets Climb to $5.6 Billion

- Colleges Big Winners in State Budget

- Pension Costs Plague Fire District Budgets

- Record Totals for School Bond Requests

- Ruling Provides A Win for Taxpayers

- ATRA Outlook Wrap Up

- Larry Lucero Given Lifetime Achievement Award

- Tax Litigation Update

- OSPB: Another Strong Revenue Year

- 2020 ATRA Legislative Program

- Arizona Lands $11.6B in Income From Migrants

- The Coming High School Enrollment Decline

- Expenditure Limits: Pension Liability Is Not Long-Term Debt

- Coronavirus Forces Legislature to Adjourn

- Teacher wages up, Competitive with Peers

- Gov Signs Bill Requiring Tax Statements Include Tax Information

- FY 2021 Taxable Property Values Up 5.7%

- County Audits Reflect Loose Spending of Taxpayer Dollars

- ATRA Tracking Local Government Tax Increases

- Gadsden Elementary's Illegal Boondoggles

- Taxpayers Win Gift Clause Challenge

- Counties Increase Property Taxes Despite Healthy Reserves

- Eastern College Raises Taxes 6% During a Pandemic

- Cities & Towns to Increase Primary Property Taxes Over $10 Million

- Counties Increase Property Taxes Despite Half Billion in CARES Funding

- Teachers Union Tax Increase on Ballot

- Maricopa Unified Sends $2 Million Bill to State

- Fire District Levies Mirror 6% NAV Growth

- Prop 208 Draws Negative National Attention

- 10 Years On, The Frozen Tax Rate Protects Rural AZ

- JLBC: State Revenues OK Despite COVID

- Prop 208 Rides Blue Wave to Victory

- ATRA Outlook Wrap Up

- Jim Rounds On The Economy

- Bark Re-Elected Chairman

- 2021 Legislative Program

- Pima College Takes Legal Path for New Expenditure Authority

- Supreme Court Deals Blow to Incentive Deals

- Assessor's Office: Skysong is a Taxable Property

- 2021 Legislative Update

- Consultant Labels La Paz County Insolvent

- Tucson Pushes Legal Limit of GPLET Program

- Tucson Unified Finally Closes Its Deseg Case

- Eastern College Maxes Out Its Tax Levy

- Struggling TUSD is Bloated & Inefficient

- Community Colleges Posture for the Future

- Legislature Passes Historic Tax Package

- 2021 Legislative Wrap-Up

- ATRA Investigation Leads to 27 Felony Indictments

- City Budgets Flush with Cash in FY 2022

- Real Per-Capita Taxes up 53% Since 1980

- Property Tax Hikes Put Outdated K-12 Transportation Formula on Display

- Stimulus Swells County Budgets

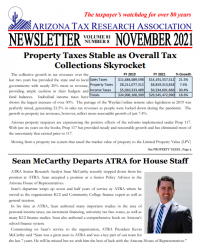

- Property Taxes Stable as Overall Tax Collections Skyrocket

- Sean McCarthy Departs ATRA for House Staff

- Local School Bond and Override Questions Bring Mixed Results

- Voters Approve $788 Million in Bonds for Chandler, Gilbert

- State Budget Director: State Budget Structurally Sound, But Inflation Poses Threat

- Riches, Roysden Provide Litigation Update

- Michelle Bolton Elected ATRA Chairman

- ATRA Briefs Major Tax Issues

- Michelle Bolton Named Outstanding ATRA Member

- Fred Nicely of COST Provides National Perspective

- 2022 ATRA Legislative Program

- Arizona's Highest Court Invalidates Pinal's Transportation Sales Tax

- Court Puts Final Nail in Prop 208

- Legislative Update

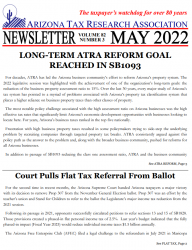

- Long-Term ATRA Reform Goal Reached in SB1093

- Court Pulls Flat Tax Referral From Ballot

- 2022 Legislative Wrap-Up

- Legislature Adjourns Long Session - Budget Agreement Includes Elimination of State Property Tax Rate

- Auditor General: Municipal Tax Code Commission A Failure

- Statewide Property Taxes Drop - A Rare Occurrence

- Highest Property Tax Rates In The State

- County Budgets Remain Strong in FY 2023

- ATRA Supports Props 130 & 132

- JLBC Director Stavneak: Recession Concerns Stunt State Revenue Growth Rates

- Economist Glenn Farley Provides Economic Outlook

- Pat Derdenger and Heidi Thomas Named 2022 ATRA Outstanding Members

- Michelle Bolton Re-Elected ATRA Chairwoman

- ATRA Briefs Major Tax Issues for 2023

- Senior EY Tax Manager Talks National SALT Trends

- 2023 ATRA Legislative Program

- ATRA Legislative Program Update

- Jack Moody Joins ATRA

- Arizona gets a "D" Grade on COST Sales Tax Scorecard

- ADOR Confirms Cities Interpretation of MRRA Inaccurate

- Sales Tax Revenues Continue Strong Growth Trend

- State Student Funding Formula Clears Senate

- College Property Taxes Per FTSE Climbing

- Community College FY 2024 Budgets Up 5%; FTSE Down 5%

- AZ Teacher Pay Jumps to 32nd in Nation

- Colleges Secure a Fourth Year of Freedom from Expenditure Limits

- City Budgets Remain Strong With Billions in Reserves

- $3.5 Billion in K12 School Bonds on November Ballots

- ATRA Outlook Conference (Nov 17th) & Golf Tournament (Nov 3rd)

- FY24 County Budgets Still Flush With Cash

- State & Local Debt Nears $39 Billion in FY 2022

- Fall Events: ATRA Golf Tournament & Outlook Conference

- Richard Stavneak Highlights Budget Deficits

- Chad Heinrich Named 2023 ATRA Outstanding Member

- Bill Molina Elected ATRA Chairman

- Alan Maguire Provides Comprehensive Review of U.S. and Arizona Economies

- ATRA Briefs Major Tax Issues for 2024

- Tax Litigation Continues to Impact Arizona Public Policy

- Legislative Leaders Address Outlook

- Stephanie Do Addresses National Tax Issues

- 2024 ATRA Legislative Program

- Arizona Continues to Benefit From Interstate Migration

- 2024 ATRA Legislative Program Update

- U.S. Census State Tax Rankings

- Teacher Pay Climbs to 31st Nationally

- Governor Vetoes GPLET Reform

- Governor Signs TPT Audit Bill

- Pinal County Transportation Sales Tax Refund Update

- Auditor General Audits Raise Serious Concerns

- Legislature Adjourns After Closing State Budget Deficit

- Major Property Tax Judgment to Hit Maricopa Taxpayers This Fall

- Community College FY 2025 Budgets up 3.6%; Audited FTSE up 1.1%

- In Memoriam Dick Foreman

- Phoenix Expands CBD - Signals GPLET Ramp Up

- Two Counties Asking Voters for Increases in Constitutional Expenditure Limits

- $2.4 Billion in K12 Bonds on November Ballots

- SAVE THE DATES: ATRA Outlook Conference & Golf Tournament